Elevate Your Financial Health And Wellness with Tailored Loan Service

Elevate Your Financial Health And Wellness with Tailored Loan Service

Blog Article

Streamline Your Financial Journey With Trusted and Efficient Finance Solutions

In the realm of individual money, navigating the myriad of car loan choices can often feel like a complicated task. When geared up with the right tools and support, the trip towards protecting a finance can be streamlined and hassle-free. Relied on and reliable financing services play a pivotal function in this procedure, using individuals a trustworthy path in the direction of their financial objectives. By understanding the advantages of collaborating with trustworthy loan providers, discovering the different kinds of finance services offered, and honing in on vital elements that establish the best suitable for your needs, the course to financial empowerment ends up being clearer. The true essence exists in exactly how these solutions can be leveraged to not only safe and secure funds however additionally to maximize your economic trajectory.

Advantages of Trusted Lenders

When seeking financial assistance, the benefits of choosing trusted lending institutions are vital for a protected and dependable borrowing experience. Relied on lenders supply transparency in their terms, supplying debtors with a clear understanding of their responsibilities. By functioning with reputable loan providers, consumers can prevent hidden charges or aggressive techniques that might result in financial challenges.

In addition, relied on lenders usually have actually established relationships with regulative bodies, ensuring that they operate within lawful boundaries and comply with sector standards. This conformity not just protects the debtor yet also promotes a sense of depend on and trustworthiness in the financing procedure.

Furthermore, trusted lenders prioritize customer care, providing assistance and support throughout the loaning trip. Whether it's making clear funding terms or assisting with payment choices, trusted lenders are dedicated to aiding customers make educated financial decisions.

Kinds Of Financing Services Available

Different banks and loaning agencies offer a diverse variety of funding solutions to satisfy the varying needs of consumers. Several of the typical sorts of financing solutions available consist of individual loans, which are generally unprotected and can be utilized for different purposes such as financial obligation combination, home remodellings, or unexpected costs. useful source Home mortgage fundings are specifically made to assist individuals acquire homes by supplying substantial quantities of money upfront that are repaid over an extensive duration. For those seeking to purchase a vehicle, auto loans offer a method to finance the purchase with repaired month-to-month settlements. Furthermore, business financings are offered for entrepreneurs looking for capital to start or increase their endeavors. Trainee lendings satisfy instructional expenditures, giving funds for tuition, books, and living expenditures during academic searches. Comprehending the different kinds of funding services can help customers make notified choices based upon their certain financial needs and objectives.

Factors for Picking the Right Financing

Having acquainted oneself with the varied range of lending services offered, borrowers must meticulously analyze vital elements to choose the most ideal finance for their details economic needs and objectives. Understanding the repayment schedule, fees, and fines associated with the financing is important to stay clear of any kind of shocks in the future - top merchant cash advance companies.

In addition, borrowers need to examine their current economic circumstance and future prospects to figure out the lending amount they can easily afford. By carefully thinking about these factors, customers can select the appropriate car loan that straightens with their financial objectives and capacities.

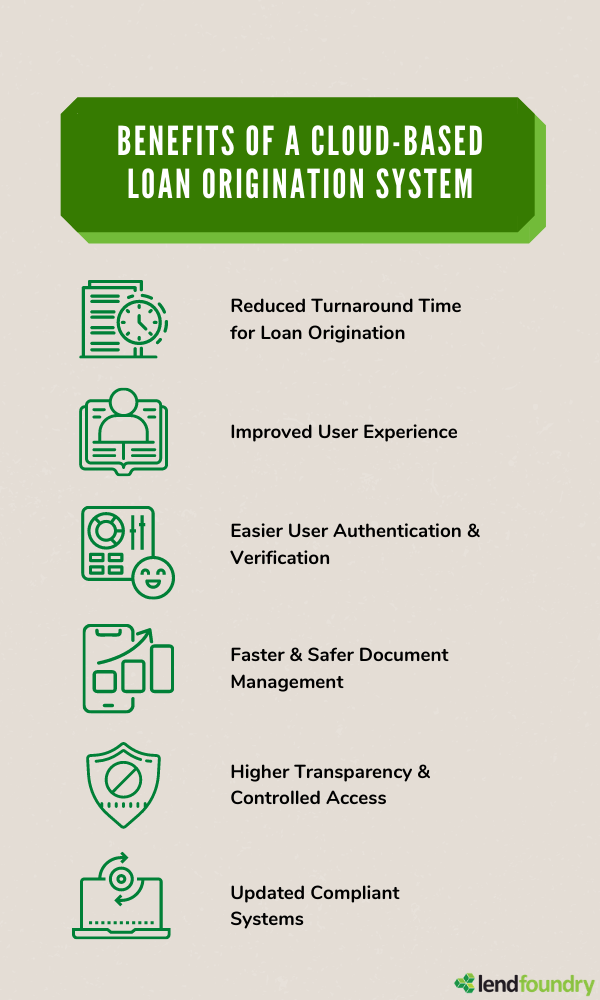

Streamlining the Funding Application Process

Effectiveness in the loan application process is extremely important for guaranteeing a seamless and expedited loaning experience - mca loans for bad credit. To streamline the car loan application process, it is important to provide clear guidance to candidates on the needed paperwork and information. By incorporating these structured procedures, funding companies can provide a more efficient and straightforward experience to debtors, eventually improving total consumer fulfillment and loyalty.

Tips for Effective Funding Repayment

Browsing the path to effective funding repayment needs careful preparation and disciplined economic management. To make certain a smooth payment trip, begin by developing an in-depth budget that includes your financing repayments. Recognizing your income and expenditures will assist you allocate the required funds for timely payments. Take into consideration setting up automated payments to stay clear of missing due dates and sustaining late fees. It's likewise advisable to pay more than the minimum quantity due each month ideally, as this can help in reducing the overall rate of interest paid and reduce the repayment duration. Prioritize your lending payments to stay clear of back-pedaling any kind of car loans, as this can adversely impact your credit report and economic security. In case of monetary difficulties, interact with your lending institution to explore possible options such as loan restructuring or deferment. By staying organized, aggressive, and economically disciplined, you can effectively browse the process of repaying your financings and achieve greater financial flexibility.

Conclusion

In verdict, using relied on and effective loan services can greatly streamline your financial journey. By carefully choosing the appropriate loan provider and kind of funding, and streamlining the application process, you can make certain a successful loaning experience.

Report this page